Today, I’m covering the renewable energy sector and making a buy recommendation. There is room for Wind and other alternatives at this company but the primary focus is utility scale solar photovoltaic plants.

A primitive selenium photovoltaic existed as early as 1839. During the early atomic age, Bell Labs improved on the design by using much more efficient silicon. The efficiency was still below the 6% deemed to be commercially viable. At any rate, there has been over a century of research and development into making better solar cells. If you were to buy a typical residential system today, you’d expect to get cells with an efficiency of about 20%. The technology exists already however for efficiency up to 26%, with 30% projected in just a few short years.

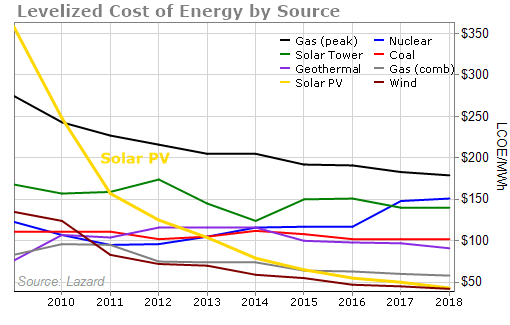

An exiting thing is happening with solar power and it is clear the adoption will be similar to other breakthrough technologies such as the digital camera. Adoption is slow at first but then it accelerates and becomes the dominant technology. The price of solar is falling rapidly and is now at the point where it is cheaper to add a new megawatt of solar to the grid than coal.

I think that soon, the cost of building new solar capacity will be lower than the cost of maintaining existing coal plants. When that happens, there will be a phase change in the mix of generation. Thus, it will not be climate change that drives adoption of renewables, but cost-effectiveness.

In 2018, the mix of renewables in the US had already hit 17% of all generating capacity. The Energy Information Agency expects that essentially ALL growth in electric production capacity going forward to come from renewable sources with coal, gas, hydro, and nuclear all declining.

So why haven’t solar cell manufacturers become market darlings? It’s simple. Each firm’s cells are about as good as their competitors and thus they must compete on price. At the same time, millions in R&D is needed to keep up with advancing technology, and the manufacturing process is capital intensive. Capital intensive industries with weak margins make for poor investment opportunities. I’m going to propose a different approach and recommend you get in on the financing of a portion of what the International Renewable Agency estimates will require $100 trillion in capital over the next few decades.

Here is the skinny. There isn’t enough capital to finance all the projects that are proposed at the moment. But it is a sure bet the money will become available over time. You see, a solar plant is a remarkably safe and stable investment that is a lot like investing in commercial real estate. You have an upfront expenditure and a well-nigh guaranteed cash flow stream that rolls in almost effortlessly for decades. And there are corporate structures to make the cash stream tax advantaged. Capital flows to where it is treated best and solar plants treat capital well.

I’m going to recommend banking on the opportunity to take advantage of the capital shortage by investing in Hannon Armstrong Sustainable Infrastructure Capital (HASI). In most cases, HASI will purchase land and lease it back to a solar operator that has locked in long term agreements with electricity customers to guarantee cash flow. It will focus on middle market lending for projects between $10 million to $75 million that are too large for simple credit financing but too small to entice the big banks to float a bond. This is a niche of lending that is very safe but earns a superior interest rate.

It isn’t just solar plants. HASI also lends to wind projects and major energy efficiency projects. There are multiple approaches the company can take. These include funding a project and keeping it in its portfolio to earn interest over time. Or Hannon Armstrong can bundle several projects and sell them as a bond to other investors. This way HASI unloads the risk and collects a lucrative management fee for its efforts.

The company also has existing relationships with key vendors such as Honeywell (HON), SunPower (SPWR), Johnson Controls (JCI), and First Solar. If a company approaches Johnson Controls with an energy efficiency project for one of its plants, JCI will likely turn to HASI to provide the mutual customer with the financing for an effort with a clearly defined benefit and that pays for itself in savings over time. Once again, HASI picks up a very safe stream of income that pays an above market interest rate and is fully collateralized.

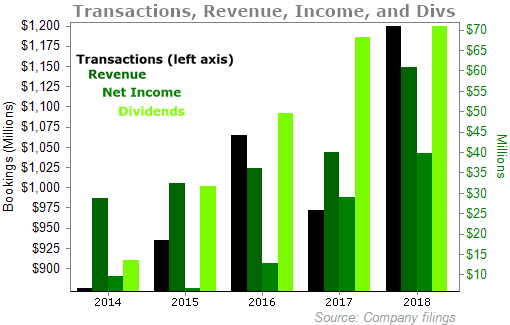

Thanks to the relationships above, Hannon Armstrong has a backlog of over 2 billion in deals it could do today as soon as the funding becomes available. It did over 1.2 billion of such deals in 2018. The pipeline is an estimate but you can see from the graph provided by HASI below that there is strong growth to power increasing revenue, income, and dividends.

I want to talk more about safety. A company like Hannon Armstrong could grow 100% a year if it lost discipline and loaned money to poor credit risks. Doing this kind of business takes discipline and I want my readers to know current management has it. They have to loan money to the right borrowers to grow and profit. Take a client that is financing an energy improvement project. A project with $1 million a year in savings might pay HASI 800 thousand in interest and principal a year. The loan actually improves the credit worthiness of the borrower. Likewise, with utility scale lending projects, it is essential to lend to borrowers that have long term agreements with customers to lock in cash flows and ensure they can cover financing plus profit.

Hannon Armstrong has lent out about $4 billion in capital in its lifetime. In that time, there has been exactly one credit loss of $11 million. That is a rate of 0.03%. The CEO has worked in energy and finance since the 1980s and has one of the best track records around. I’m comfortable placing money with this management team.

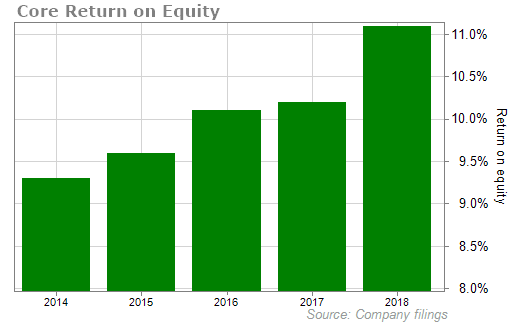

But what is in it for YOU the investor? Let’s look at the financial track record of the company. I think the key metric here is Return on Equity. See the chart below to see that results are strong AND steadily improving.

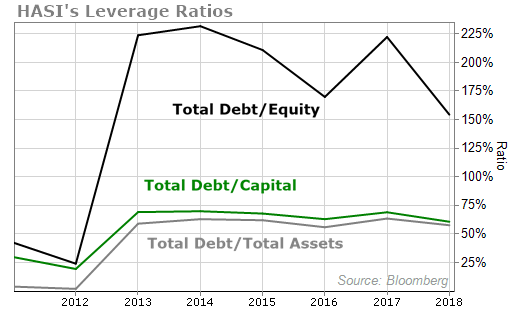

As far as financial safety, the following chart demonstrates that the company is become safer by lowering its leverage over time, even as profitability soars.

Shares yield a little under 5% today but that is a good return for a growing Real Estate Investment Trust (REIT) – [That is a legal corporate organization scheme that allows the trust to be exempt from federal taxes by distributing substantially all of its cash profits to share holders as dividends]. In today’s low interest rate environment, safe yields this high are hard to come by. And it should be noted the company has established a history of growing its distribution. You can see the history at the NASDAQ history page.

ACTION TO TAKE: Buy Hannon Armstrong Sustainable Infrastructure Capital (NYSE: HASI) up to $28 per share. Put no more than 5% of your investable capital in any one idea. Protect yourself from losses with a 25% trailing stop loss. Reinvest your dividends to maximize compounding.

One thought on “The Trillion Dollar Investment Opportunity In Renewable Energy”